Microsoft’s latest financials, and Phil Spencer’s subsequent comments during the Wall Street Journal Live event, felt like a shift in tone.

The big takeaway for some is how Microsoft, for the second quarter running, failed to hit its targets around Game Pass subscription growth.

I am reluctant to draw conclusions from results posted during the last six months. Not only has there been a significant lack of major titles, but it also covers the first full post-lockdown summer, when people actually went on holiday. It was inevitable video game targets were going to get missed, and Microsoft isn’t the only one to experience that.

But what was more noticeable were the comments that came alongside the news. Phil Spencer estimated that Game Pass will probably only account for around 15% of Xbox’s content and services revenue going forward and stated: “We don’t have this future where I think 50% to 70% of our revenue comes from subscriptions.”

15% sounds low when you consider the billions of dollars that Microsoft has spent on games and developers, all in the name of Game Pass. Surely this wasn’t the dream?

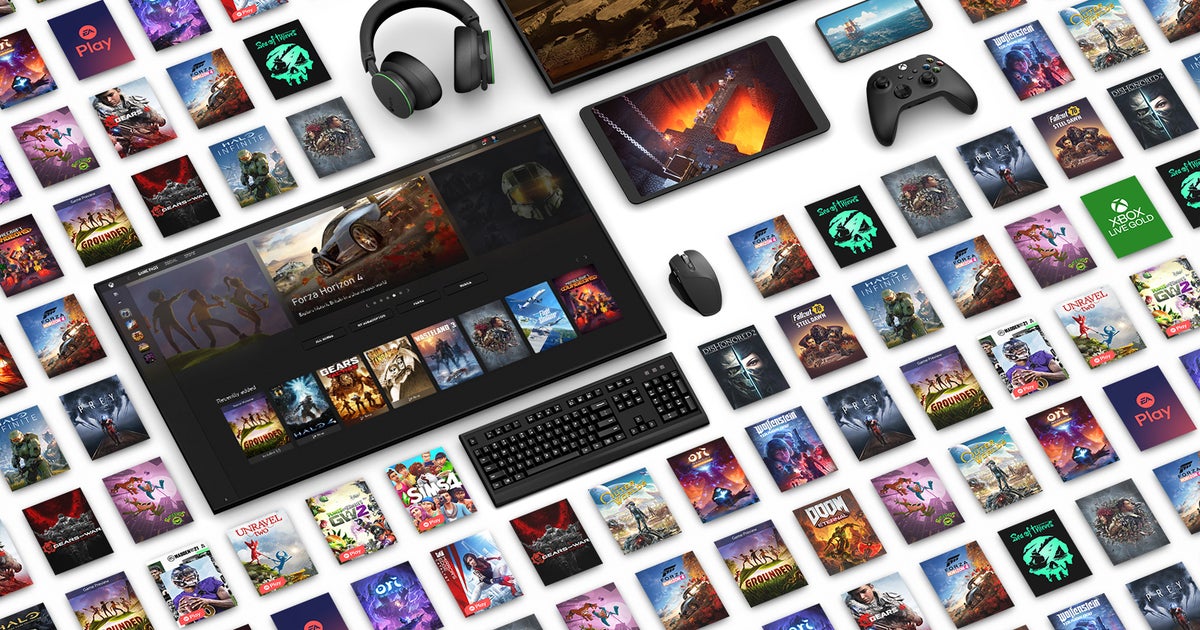

Xbox has done a great job with Game Pass. The branding work and messaging around the service has made it the industry’s flagship subscription platform. It may not have the most users, but every other service – from PS Plus to Apple Arcade – gets compared to it.

And it’s become somewhat of a system seller, too. For the first time since the PS2 with its DVD player, a games console has a killer app that isn’t a specific video game. Microsoft announced during its financials that half of those who have bought the cheaper Xbox Series S machine are new to the Xbox ecosystem, and it’s easy to imagine that Game Pass played a part in unlocking some of those new players.

Yet despite these successes, Game Pass momentum has been held back by a series of obstacles. First, there’s the spotty release schedule – partially due to COVID-19 and the subsequent move to hybrid working. This should be a temporary situation, but the ideal of a regular cadence of big games dropping into Game Pass is still a way off. And it’s a situation made harder by the fact that AAA publishers are unwilling to put their big new titles into the service.

Next, there’s free-to-play. The real competitor to Game Pass is not $70 games, but that the biggest titles on the market – such as Fortnite, Call of Duty Warzone and Roblox – are all free. Microsoft is trying to find ways to make free-to-play work within Game Pass, such as through its partnership with Riot Games, but it’s yet to figure it out.

And then there’s the reality that, for a lot of people who only play a handful of games a year, a subscription service just doesn’t make much sense.

All of those are legitimate reasons as to why Microsoft may be playing down the potential of Game Pass, particularly on consoles, which is where Spencer says growth is starting to slow.

This may sound negative, and a significant change in tone for Xbox, but the truth is it’s not radically different to what we’ve heard before. In an interview we conducted with Sarah Bond last year, she told us that Microsoft doesn’t expect subscriptions to become the dominant business model. And it’s something the company has repeated, although 15% still seems lower than many expected.

And you have got to consider the backdrop in which these comments are being made. Microsoft’s major acquisition of Activision Blizzard is currently being scrutinised and debated by regulators around the world. And some of the data that Microsoft is choosing to share is no doubt in relation to that.

One of the big concerns from the UK regulator (the CMA) is around Game Pass and Microsoft’s potential dominance in the games subscription and streaming space. By revealing that Game Pass accounts for just 15% of its content and services business, Xbox is pointing out that even if Game Pass becomes the most popular subscription service in games, it’s ultimately just one business model, and not even the biggest one.

Another message to the regulators came in Spencer’s comments around PC and mobile.

Microsoft revealed that Game Pass had grown by 159% on PC, which matches recent comments we’ve received from indie publishers about the service’s growing popularity. Speaking anonymously to GamesIndustry.biz, one indie publisher predicted that Game Pass would soon emerge as the main rival to Steam, not Epic Games Store.

And as for mobile, Spencer talked of a desire to end the control of Apple and Google, and even stated that Call of Duty mobile was more interesting to Microsoft than the high-profile console versions.

This is not too different to our own analysis of the acquisition earlier this year. By acquiring Blizzard, Microsoft will have major PC brands like Diablo and Warcraft, which – alongside Call of Duty – will bolster PC Game Pass and offer a viable competitor to Steam. And through titles like Candy Crush (and Call of Duty) Microsoft will have a significant presence in mobile in which to develop a business there.

Through talking about this, Microsoft is responding to fears that this acquisition might harm competition in the console space, by highlighting how it will boost competition on PC and mobile. In other words, this isn’t about just competing more strongly with Sony, but Apple, Google and Valve, too.

It’s a compelling argument, but there are still some doubts and concerns around this. When it comes to PC, Game Pass is not a like-for-like competitor to Steam. And some of the indie publishers we have spoken to are apprehensive about what a popular PC subscription service might mean for premium indie titles. One publisher even pointed to the impact Netflix has had on the cinema, and particularly the smaller theatrical releases.

These fears are not currently substantiated by the data, but it’s something that the industry (including Microsoft) will be mindful of. Microsoft will want to make sure that competing with Steam will create more opportunities for developers, not fewer.

As for mobile, it’s not clear how Microsoft plans to seriously compete with Apple and Google. Candy Crush and Call of Duty, combined with Xbox Game Streaming, would give the company a strong presence on mobile that it didn’t have before. But it doesn’t feel deep enough to offer significant competition to Google Play or the App Store.

Nevertheless, through its latest results and Spencer’s comments, Microsoft is looking to move the conversation away from consoles and Game Pass, and presenting a wider view of the games business. A view that, it hopes, will show how its $69 billion Activision Blizzard acquisition will make the market more competitive, not less.