This Week in Business is our weekly recap column, a collection of stats and quotes from recent stories presented with a dash of opinion (sometimes more than a dash) and intended to shed light on various trends. Check every Friday for a new entry.

Take-Two joined the parade of publishers with a round of triple-digit layoffs this week, announcing plans to cut headcount by approximately 5%.

It’s awful, as all such layoffs are. And it reflects poorly on the management who did not run the business in a way that wouldn’t lead to hundreds of employees’ lives being upended, as all such layoffs do.

That this belt-tightening comes less than three weeks after Take-Two decided it could afford $460 million to acquire Borderlands developer Gearbox makes it look that much worse.

Looking at the layoffs all on their own, it’s not difficult to see what Take-Two is thinking. On top of the general “economic headwinds” that even the most profitable companies in the industry have been using as a reason to cut staff, Take-Two specifically hasn’t been profitable of late. The company has reported seven straight quarters of net losses and its forecast says it will be eight-in-a-row once it reports its earnings next month.

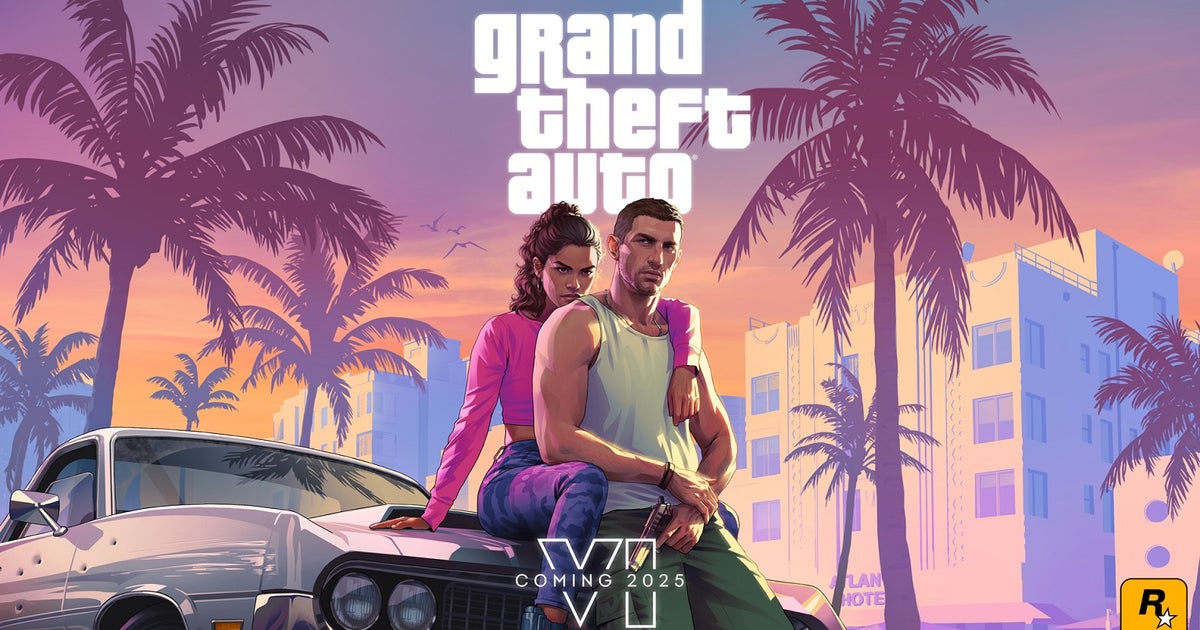

So why is it splurging for Gearbox now, when it’s had a rough stretch and isn’t expecting the long-awaited Grand Theft Auto 6 to come and save the day until next year at the earliest?

Well, the Gearbox acquisition looks opportunistic to me, a chance for the publisher to get a deal on a valued asset. Embracer’s struggles have been well-documented, and it could kindly be described as a motivated seller here. Gearbox is also uniquely valuable to Take-Two, which already had the publishing rights to Borderlands but now owns the IP outright and has control of the franchise’s success going forward.

That’s the sort of deal I would expect Take-Two to pursue almost regardless of its current financial situation because it can’t expect to have a similarly beneficial array of factors in its favor whenever the company switches from red ink to black. Gearbox might not be up for sale in 2025 or 2026, and if it is, it would still likely cost more to acquire than right now.

But acquiring Gearbox meant significantly adding to Take-Two’s overall headcount, which is something the publisher apparently doesn’t have an appetite for.

STAT | 550 – The number of employees working at Gearbox when the studio was acquired by Embracer in 2021.

STAT | 580 – 5% of the full-time staff figure Take-Two reported in its last annual report, or approximately the number of employees Take-Two plans to layoff this year.

Both those numbers are outdated by now, especially considering there were layoffs at Gearbox a week after the deal was announced. Regardless, the number of people Take-Two agreed to bring in with the Gearbox deal and the number of people it plans to ship out by the end of this year are likely in the same ball park.

Maybe these two things aren’t quite as directly related as that might make it seem. Certainly, Take-Two could have done either the Gearbox acquisition or the layoffs alone, and we wouldn’t have terribly surprised at either move in isolation. But I can say that the mass layoffs represent a change in the company’s approach to cost-cutting, at least publicly.

This is the third cost reduction plan for Take-Two in the past 14 months, but for the first two, Take-Two CEO Strauss Zelnick at least implied a desire to limit layoffs as the company embarked on cost cutting efforts.

QUOTE | “We don’t expect any kind of broad-based reduction in force. We are going department by department and trying to drive efficiency.” – Zelnick told us in February of 2023 when the first cost reduction plan was announced that Take-Two would try to be “very diligent about looking at the overhead.”

When Take-Two announced its second cost reduction plan two months ago, Zelnick similarly suggested the company could find the desired savings without mass layoffs.

QUOTE | “Remember, our cost profile isn’t just about headcount. Our biggest line-item expense is marketing, actually. So optimizing marketing would be a terrific way to make sure the company gets more efficient.” – Zelnick two months ago, as the company announced its second “cost reduction plan.”

He also told IGN at the time that the company had “no current plans” for layoffs, though he didn’t rule them out either.

That doesn’t mean the company was skipping layoffs entirely. There were cuts reported across Private Division, Firaxis, 31st Union, and Visual Concepts Austin under those previous plans.

The company described the Private Division cuts as “targeted” with a “minimal” impact on dev teams. 31st Union’s cuts were fewer than ten staff, while a person laid off from Visual Concepts Austin said they were let go alongside “several” colleagues. Firaxis seems to have been the hardest hit, losing 30 employees on the heels of Midnight Suns’ release.

But both of the previous cost-cutting programs were announced alongside earnings reports, which is why we have Zelnick’s characterization of them on the record. And the overall number of cuts wasn’t large enough as to have the publisher disclosing the scope of them to federal regulators. In contrast, this week’s plan was announced via an SEC filing, with no other attempt to provide context or spin the news in a less damaging fashion.

QUOTE | “The Plan is expected to be largely complete by December 31, 2024 and will reduce the Company’s workforce by approximately 5%.” – In its SEC filing announcing the cost reduction plan this week, Take-Two was clear enough that this is going to hit a lot of people.

Regardless of whether you take him at his word, Zelnick’s statements around the first two cost reduction programs at the very least suggest a desire to reassure Take-Two’s employees that the company didn’t want to resort to layoffs.

From the depth of these latest cuts to the way they were announced, their proximity to the Gearbox deal, and the possibility that employees won’t know if they’re being laid off for eight more months, these layoffs are almost a mirror opposite, leaving Take-Two employees with a pick-your-poison scenario.

On the one hand, I sort of hope Take-Two tells people whether they’re staying or going ASAP, because the entire company spending the next eight months in limbo wondering if they (and their hard work) will get tossed to the curb would be just awful. That sort of uncertainty weighs on people, and Take-Two is probably not going to be getting their very best work as long as the situation lingers.

On the other hand, if I were the one getting cut, I might prefer the eight extra months of employment (during which I would absolutely be scrimping and saving while looking for work) and then severance on top of that, hopefully giving me enough runway so that the industry is in hiring mode again by the time my need for new work becomes urgent.

Either way, morale is going to take a hit, and as Take-Two bids farewell to the talent it can live without, they will no doubt soon be followed by some of the talent it would much rather hold onto.

Pretend I had a clever Zynger here

Whatever happens, the Gearbox deal is going to loom large over these layoffs, but then again, so could the 2022 acquisition of Zynga.

I mentioned above that Take-Two has posted seven straight quarters of net losses, which is a pretty ugly stretch for a company that had been quite consistently profitable before that.

STAT | 18 – Take-Two reported a net profit for 18 straight quarters prior to its current losing streak, a run that stretched from October of 2017 through March of 2022.

If you want to downplay the last couple years of that run because running a game company at the start of a global pandemic is like playing on easy mode, I’m totally okay with that for reasons that will become apparent in a few paragraphs.

So what happened during the next quarter to break that streak and send Take-Two into its current slump? A natural suspect would be the closing of Take-Two’s $12.7 billion deal to acquire Zynga.

STAT | 6 – Over the same stretch that Take-Two was reporting profits for 18 quarters straight, Zynga only reported profits six times.

STAT | 1 – Of the eight “easy mode” quarters between the start of the pandemic and the acquisition by Take-Two, Zynga only managed to post a profit once, cumulatively losing $454 million over that stretch.

So Take-Two was a profitability machine, then it bought a huge company with a lengthy track record of losses despite favorable market conditions, and instantly switched to building its own lengthy track record of losses. It might be tempting then to say the Zynga deal has been an anchor on Take-Two’s business, but that’s a little too simplistic.

As much as I have always been skeptical of Zynga’s business in the past, both financially and ethically, what’s happening at Take-Two is clearly about more than just Zynga.

STAT | $150 million – The largest quarterly loss Zynga posted during Take-Two’s run of profitability, one of only four quarters over that stretch that topped $100 million in losses for the company.

STAT | $610 million – The largest quarterly loss Take-Two posted since the Zynga acquisition. Of the six quarters since the acquisition closed, Take-Two has posted losses larger than $150 million in five of them.

So Zynga’s not entirely to blame here. Take-Two’s entire business has been dealing with the same pandemic bubble hangover as the rest of the industry, and hasn’t been helped by product cancellations and apparent underperformances from games like Lego 2K Drive and Midnight Suns, not to mention a soft start for NBA 2K24.

But it’s tough to say how much of Take-Two’s woes are coming from which parts of the business, because it largely reports its earnings the same way it did back when it was just a publisher of AAA console and PC games. And while that might still be the way people think of Take-Two, the acquisition of Zynga (along with Social Point and Nordeus) has turned the company into a majority mobile business, at least for now.

STAT | 52% – In its most recent quarterly report, Take-Two noted that 52% of its revenue came from mobile platforms.

As a publicly traded mobile game publisher, the stand-alone Zynga relied on different metrics to give investors a good idea of the health of the business: Daily active users, monthly active users, average bookings per user, monthly unique payers… Combined with the standard revenue, net income and the like, it’s enough information to cobble together a reasonable idea of how a mobile gaming business was running.

We get none of that from Take-Two. Beyond a simple revenue or bookings total, Take-Two doesn’t say much about mobile at all at this point. We might get a few games showing up on the list of titles that drove sales and perhaps one or two mobile titles singled out as exceeding expectations, but virtually nothing in the way of hard numbers.

While the way Take-Two reports earnings is perfectly reasonable for a console and PC company – I particularly appreciate how willing the company is to share actual sold-in figures for games, something many of its peers refuse to do even when they have hits – the insight it gives into what is the largest part of its business (depending on the quarter) is distinctly unimpressive.

Activision Blizzard underwent a similar shift in its business when it acquired King in 2016. Overnight, a console and PC publisher with a very modest presence in mobile became one of the more meaningful players in the mobile space. But rather than lump King’s very different business into its own and call it a day, Activision Blizzard added it as another division for which it would give separate revenue, operating profit, and active user numbers in addition to its standard all-inclusive figures.

As much grief as I have given Activision Blizzard in this column over the years – and as much joy as I have sometimes taken from giving that grief – investor relations is one area where I always thought the company did a commendable job.

I could follow Activision Blizzard’s financial reports quarter-to-quarter and roughly understand what was working and what wasn’t: “King’s really doing the heavy lifting this quarter. Blizzard has seen declining profits for a while now, that’s a little concerning. Call of Duty has been killing it lately but Activision’s active users haven’t even budged upward. What’s up with that?” (It’s a shame they’re now part of Microsoft, which denies us any substantial insight into its games business.)

With Take-Two, it’s all just one undifferentiated mass that reliably ends up with Grand Theft Auto and NBA 2K on top.

Will Take-Two have second thoughts?

Take-Two’s reporting method is a little self-defeating because this lack of insight into the mobile business only serves to reinforce a perception it has been trying to shake for decades: That the only thing that really matters for Take-Two is Grand Theft Auto.

QUOTE | “The problem created when you make the biggest franchise in the business is that other huge hits don’t look like huge hits.” – Shortly after joining Take-Two as chairman of the board in 2007, Zelnick insisted for perhaps the first time (with many, many more to come) that Take-Two is not solely reliant on Grand Theft Auto.

It has been an uphill battle, and one driven as much by acquisitions as organic growth, but I think Take-Two has largely outgrown its reliance on needing a new Grand Theft Auto to sell people by any reasonable measure. (And not just because Grand Theft Auto Online has given it an old Grand Theft Auto that it can sell to people at a rate of millions per quarter even a decade after release.)

In terms of needle-moving franchises, Take-Two has NBA 2K, Red Dead Redemption, Civilization, BioShock, Borderlands, WWE 2K, XCOM… And that’s just in the console/PC space. There’s still a whole other half of the business with Zynga’s “forever franchises” like CSR Racing, Zynga Poker and Words With Friends, Rollic’s hypercasual offerings, Merge Dragons, Top Eleven, Two Dots, and more.

We’re at the point where Take-Two can go a decade without a new Grand Theft Auto release and it’s still the most successful decade in the company’s history.

But in the market’s eyes, the performance of all those other games and franchises combined is almost irrelevant next to Grand Theft Auto, so much so that despite recent declining sales and mounting losses, Take-Two stock is performing just fine largely because there’s a new Grand Theft Auto penciled in for next year.

STAT | 19% – Take-Two opened the week’s trading above $147, or about 19% higher than where it was at this point last year. (It did actually dip a bit after the layoffs, and as of this writing is only up about 14%.)

At the moment, Grand Theft Auto is simultaneously Take-Two’s golden goose and silver bullet, a one-of-a-kind panacea that can prop up the share price and make up for shortfalls elsewhere in the business. But the expectations around Grand Theft Auto 6 are beyond huge, even by Grand Theft Auto’s standards.

QUOTE | “There’s probably never been a more important thing to ever release in the industry, so no pressure.” – Circana analyst Mat Piscatella, explaining in an interview with us why there may be hope for an industry rebound in 2025.

For as long as Grand Theft Auto 6 plays the role of the cavalry ready to swoop in and save the day, it might benefit Take-Two to be seen as the Grand Theft Auto outfit and not much else.

But if Grand Theft Auto 6’s first brush with reality falls short of the expectations investors have for it in any way, Take-Two might regret not being more aggressive on educating them as to the workings of its mobile business.

The rest of the week in business

STAT | Around 10% – Kwalee has reportedly laid off as much as 10% of its employees as it restructures to pursue “a differentiated strategy to take advantage of organic and acquisitive growth opportunities.” Gotta suck for current staff to hear the bosses are laying off them or their co-workers because they’d rather buy someone else than take good care of the employees they already have.

QUOTE | “Those kinds of experiences change you. A layoff is not something that happens just on a balance sheet. It’s not just numbers. It also impacts people, both those who have to leave and those who stay.” – Glow Up Games co-founder and CXO Latoya Peterson explains how repeated mass layoffs during her time in media at ESPN and Al Jazeera changed the way she thought about the duty an executive has to their employees.

QUOTE | “The salaries that were being paid [as companies expanded] blew our minds – people were getting £10,000 or £20,000 more than they normally would have. By summer 2022, companies were stuck with super high recruitment costs, plus super high employee costs, and the funding was already starting to dry up. [Recruitment] is very much a barometer for what’s coming.” – In talking with us about closing her recruitment firm OPM after 26 years, Kim Parker-Adcock explains how companies brought a lot of this on themselves with reckless behavior during the pandemic.

QUOTE | “I have expressed a strong desire to the teams not to grow. The teams have told me in extreme detail why we needed to grow, so there’s that fight going on right now. I’m actually the one that is trying to hold it back. And they have legitimate reasons why they want to grow it, because they have ambitions they need to achieve, so we’re trying to keep it sane.” – Despite the success of Baldur’s Gate 3, Larian CEO Swen Vincke is wary of growing just because the studio has the resources to do it right now.

QUOTE | “I don’t think sustainability is a utopian idea. It’s just a necessity. Everything you do cannot guarantee survival, but you should at least create the conditions for it to occur.” – Xalavier Nelson Jr. likewise says it doesn’t have to be this way.

STAT | 22 years – How long Schell Games has been in business without laying people off, which CEO Jesse Schell tells us is because the company is willing to bet cash on things, but it won’t bet jobs on them.

STAT | 18 days – The time between CI Games wrapping up a year of record revenues and laying off 10% of staff.

STAT | 8 days – The time between the premiere of the Fallout TV series on Amazon Prime and the online retailer formally renewing the show for a second season.

STAT | 300% – In the first three days after the Fallout TV show launched, daily revenues for Fallout Shelter quadrupled, according to Sensor Tower, jumping 300% to $80,000 a day.

STAT | 1 – Fallout 4 was the best-selling game on GSD’s European Top 10 digital and physical chart this week thanks to the premiere of the Fallout TV show and some discounting on the franchise across all platforms. The Top 10 also featured Fallout 76 (8th place), Fallout: New Vegas (9th place), and Fallout 3 (10th).

STAT | 4.4% – The UK games market grew 4.4% over 2023 to £7.82 billion in revenues, according to UKIE’s Consumer Market Valuation Report.

QUOTE | “[Epic’s] complaints about the new framework ask this Court to micromanage Apple’s business operations in a way that would increase Epic’s profitability.” – Apple responds to Epic’s request that it be held in contempt of court for complying with a rule to open up iOS to alternative payment methods, but imposing onerous terms on it that require developers to apply for permission and still see Apple taking nearly the same cut of sales.

I don’t know, Apple. If you’re going to comply with the letter of the court order but clearly violate the spirit of it, maybe you’ve just shown that you’re not operating in good faith and need a little micromanaging.